November 3, 2020

Ag Economy Barometer rises to record high on improving financial conditions

|

|

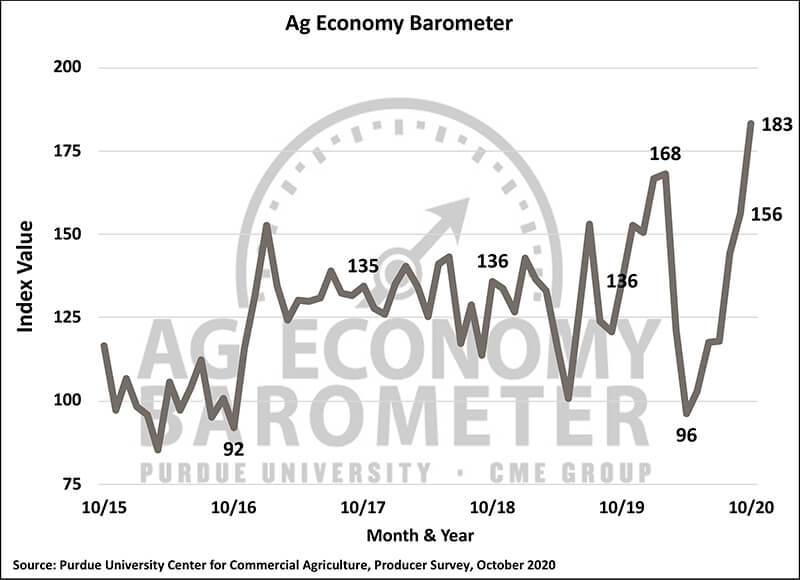

Ag Economy Barometer rises to record high on improving financial conditions. (Purdue/CME Group Ag Economy Barometer/James Mintert) |

WEST LAFAYETTE, Ind. and CHICAGO — The Purdue University/CME Group Ag Economy Barometer rose 27 points to a reading of 183 in October and set an all-time high for the index. Farmers were more optimistic about both the future and current financial situation on their farms as the Current Conditions Index rose 36 points to a reading of 178 and the Future Expectations Index rose 23 points to a reading of 186. The Ag Economy Barometer is based on survey responses from 400 U.S. agricultural producers and was conducted Oct. 19-23.

“Since bottoming out this summer, the ag economy has rebounded sharply, and the dramatic improvement in sentiment reflects the turnaround in the farm income picture,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Mintert was referring to a late summer/early fall rally in commodity prices combined with government program payments arising from the second round of the Coronavirus Food Assistance Program (CFAP 2), which provided a boost to many producers’ farm income. Corn and soybean prices continued to rally even though U.S. corn yields are expected to set a record high and the U.S. Department of Agriculture projects soybean yields to be the fourth highest on record.

“Together the combination of good yields, a rally in crop prices and CFAP 2 payments set the stage for an all-time high in the barometer and farmer sentiment,” Mintert said.

That optimism was reflected in many ways. Comparing their farm’s financial condition today to one year ago, 25% of survey respondents said their farm was better off financially now than at the same time last year. This was the most positive response from producers to this question in the history of the barometer survey.

The Farm Capital Investment Index also hit an all-time high in October, up 9 points from September to a reading 82. The percentage of producers expecting to increase their purchases of machinery in the upcoming year rose to 14% from 11% a month earlier, and up from just 4% back in May. Even more importantly, the percentage of respondents who plan to reduce their purchases in the next year was 33%, down from 40% in September.

The short-run outlook toward farmland values also improved. Respondents expecting land values to rise over the next 12 months rose to 27%, up from 23% in September. The percentage expecting lower farmland values declined to 9% from 12%. There was also a big shift in sentiment in the October survey regarding 2021 cash rental rates for farmland. Nearly four out of 10 (38%) respondents said they expect cash rental rates to increase in 2021. In September, just 8% of producers said they expected to see higher cash rental rates for farmland in 2021.

Producers also became more optimistic about trade with China this month. Nearly six out of 10 respondents (59%), said they expect to see China fulfill the food and agricultural import requirements outlined in the Phase One trade agreement with the U.S., compared with just 47% in September. When asked for their overall perspective on U.S. ag exports, the percentage of producers expecting exports to rise over the next five years increased to 65% in October, up from 58% in September.

Read the full Ag Economy Barometer report here. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available, and for even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that impacts farmers. Available here.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

Writer: Kami Goodwin, 765-494-6999, kami@purdue.edu

Source: James Mintert, 765-494-7004, jmintert@purdue.edu

Media Contacts:

Aissa Good, Purdue University, 765-496-3884, aissa@purdue.edu

Dana Schmidt, CME Group, 312-872-5443, dana.schmidt@cmegroup.com

Related websites:

Purdue University Center for Commercial Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/

Agricultural Communications: (765) 494-8415;

Maureen Manier, Department Head, mmanier@purdue.edu