November 7, 2017

Ag Economy Barometer: Producers more optimistic in October

|

|

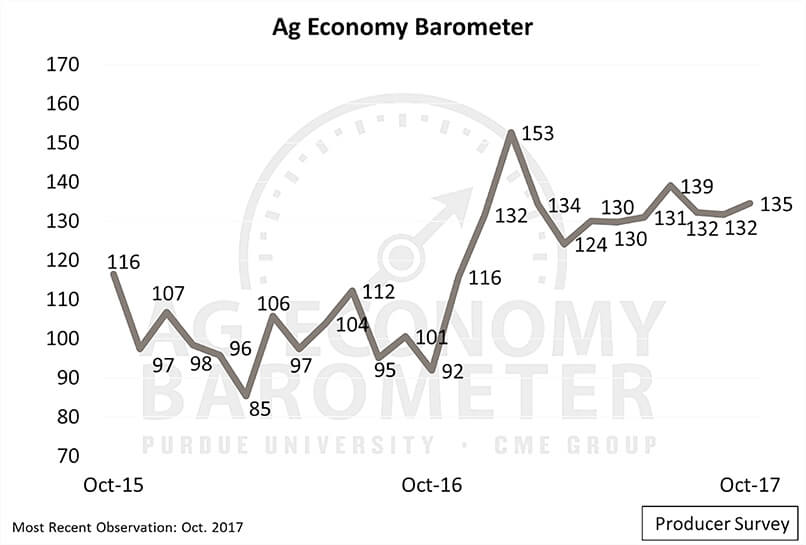

The Purdue/CME Group Ag Economy Barometer climbed to 135 in October, the third-highest producer sentiment reading since data collection began in 2015. (Purdue/CME Group Ag Economy Barometer/David Widmar) |

WEST LAFAYETTE, Ind. and CHICAGO – Producer sentiment toward the agricultural economy improved slightly in October, according to a monthly survey of 400 agricultural producers from across the United States.

The Purdue University/CME Group Ag Economy Barometer landed at 135 in October, up three points from September. It represented the third-highest reading since data collection began two years ago.

The improvement was driven by the Index of Future Expectations, which increased from 130 in September to 137 in October. The Index of Future Expectations is one of the barometer’s two sub-indices. The other, the Index of Current Conditions, weakened slightly.

For the second year in a row, producers were asked whether they plan to make management changes, such as lowering fertilizer or seeding rates, or adjusting their hybrid or variety packages for the upcoming cropping season. The share planning reductions in seeding rates and changes to their hybrid or variety choices for 2018 changed little from last October with 19 percent expecting lower seeding rates and 35 percent planning to adjust seed variety or hybrid packages. But the percentage of producers planning to reduce fertilizer usage in 2018 was noticeably smaller. Just one-third of respondents said they plan to reduce fertilizer rates in 2018, down from 46 percent a year ago.

“One possible reason for the smaller share of producers planning to reduce fertilizer rates in 2018 is prices,” said James Mintert, director of Purdue’s Center for Commercial Agriculture and principal investigator on the barometer project. “Fertilizer prices, particularly for anhydrous ammonia, are lower than a year ago. For example, recent price quotes for anhydrous ammonia were 20 percent lower than a year ago, with other crop nutrient prices exhibiting smaller price declines.”

Each quarter, producers are asked their expectations for crop prices in the coming year. Compared to July, fewer producers expect higher corn, soybean and wheat prices in the next 12 months. However, fewer producers also expect crop prices to decline over the next year.

For the first time, producers were asked about their expectations for farmland rental expenses in 2018. An overwhelming 80 percent of respondents said that they expect farmland rental rates to be unchanged in 2018 compared to 2017. The remaining 20 percent of respondents were split equally between those expecting rental rates to be higher and those expecting lower rates in 2018.

The full October report includes more information about producer sentiment toward farm machinery prices and overall farm expenses, as well as insights from the quarterly Agricultural Thought-Leader Survey. Read the full report at http://purdue.edu/agbarometer.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University's Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. Through its exchanges, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. CME Group provides electronic trading globally on its CME Globex platform. The company also offers clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives through its clearinghouses CME Clearing and CME Clearing Europe. CME Group’s products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT, Chicago Board of Trade, KCBT and Kansas City Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. Dow Jones, Dow Jones Industrial Average, S&P 500 and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor's Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

Writer: Jennifer Stewart-Burton, 765-496-6032, jsstewar@purdue.edu

Sources: Jim Mintert, 765-494-4310, jmintert@purdue.edu

David Widmar, 765-494-0848, dwidmar@purdue.edu

Chris Grams, 312-930-3435, chris.grams@cmegroup.com

Related website:

Purdue University Center for Commercial Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/

Agricultural Communications: (765) 494-8415;

Shari Finnell, sfinnell@purdue.edu